Ronald Reagan created a FREE energy market by removing the Nixon price controls, the New York Mercantile exchange (NYME) was created to exchange oil and gas commodity contracts. The idea was that a free buy order (bid) would be met by a free sell order (ask).

This setup did not cater for the large volume transaction that was traded as ‘over the counter’ or off the exchange. The NYME oil or gas price was a starting point for price negotiations only (ie a benchmark) . As all large volume transactions are OFF exchange this opened the door to shadow deals to be done. Regulators are unable to audit transaction as both parties are NOT required to disclose the details.

The presence of the NYME gives the illusion that the gas and oil market is a FREE and well regulated market, yet the truth is far from it. How can it be when the largest transactions are completed in secret. No body knows the buyer or seller, the price, the delivery, nothing.

The main reason over the counter transactions (OTC) are happening at all is that if you can control both the buyer and the seller side of the market you have the ideal money making business model. You can control both sides because you have VOLUME on both sides, this means price manipulation can be completed with ease.

In the middle of the USA there are large oil tankers that hold the world largest on land oil supply, some for the US military and US national supplies, yet most is owned by bankers and investors. Nobody knows for sure as its a black hole, as there is no disclosure. When I mean nobody knows for sure, that means you and I, the public, the Super Bankers know all the detail (JP Morgan, Goldman Sachs, New York Federal reserve, etc). What this means simply is if a banker invest a large amounts of CASH to short the crude oil market (ie they want it to fall in price), they KNOW they will win as the can materially effect supply by releasing oil stock from the on land oil tankers mentioned above to force prices down, and thus make a huge profit. Remember when oil went from $148 to $30 in 12 months in 2008, yip thats the bankers making huge profits.

The Point Is.

1) It is clear the so called free markets based on futures contracts that do not include all transactions (ie the large volume one) can suffer price manipulation, thus be controlled by large bankers.

2) Its a fantastic money making business model to be able to control both the sell and buy side of a market. This is made possible by the non disclosure of large player positions and the ability to own the underlying commodity in massive quantities for very little money down ( ie 96% leverage). This business model is only available to those that can put up billions ( ie Bankers).

3) The term free market is an illusion for the masses.

4) How can a banker get billions, easy when the Federal Reserve prints money and lends it to you at ZERO percent ( ie TARP, POMO etc)

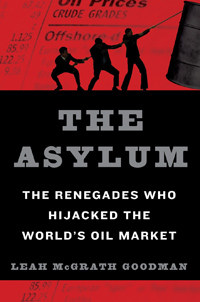

Don’t believe me, then read this book.

The above I talk about the crude and gas market. It is the same for silver and all the grains. Energy and food are the markets that bankers can build their ultimate business model around, own both the sell and buy side of the market, to give them the power of price manipulation. This is known as GAMING the market, the casino has rigged the deck, the banker wins every play.

QUESTION: What has this got to do with climate change?

ANSWER: Have you not heard John Key talking about sending our carbon credits to a global exchange to be traded on a FREE market. If you think food and energy markets attracted the price manipulating bankers, then the ultimate market to game would be the ‘Carbon Market’. You had better believe it !

It is all a crock..unless your a banker who can play with billions, then its the ultimate money making business model